Allowance Allocation Methodology for 2022

Under the American Innovation and Manufacturing (AIM) Act, the U.S. Environmental Protection Agency (EPA) was provided authority to phase down Production/Produce Production/Produce means the manufacture of a regulated substance from a raw material or feedstock chemical (but not including the destruction of a regulated substance by a technology approved by the Administrator as provided in § 84.29). The term production does not include: (1) The manufacture of a regulated substance that is used and entirely consumed (except for trace quantities) in the manufacture of another chemical; (2) The reclamation, reuse, or recycling of a regulated substance; or (3) The inadvertent or coincidental creation of insignificant quantities of a regulated substance during a chemical manufacturing process, resulting from unreacted feedstock, from the listed substance's use as a process agent present as a trace quantity in the chemical substance being manufactured, or as an unintended byproduct of research and development applications. and Consumption Consumption, with respect to a regulated substance, means production plus imports minus exports. 1 of hydrofluorocarbons (HFCs) to 15% of their baseline levels in a stepwise manner by 2036 through an allowance allocation and trading program. This web page describes the steps EPA took to calculate each entity receiving allowances for calendar year 2022. The list of current allowance holders is available on the Issuing Allowance Allocations web page.

- Methodology for general pool allowances (for production and consumption)

- Methodology for application-specific allowances

How do Allowances Work?

An allowance represents the privilege granted to a company to produce or import HFCs in a given year. Producing HFCs requires expending both “production allowances” and “consumption allowances.” Importing bulk HFCs requires expending consumption allowances. EPA intends to issue allowances by October 1 for use in the following year and they are valid between January 1 and December 31 of a given year. Allowances may not be banked or carried over to another year. Allowance holders may transfer their allowances to other entities seeking to produce and/or import HFCs. EPA publishes an up-to-date list of current allowance holders here.

A third category of allowances called “application-specific allowances” may be used to either produce or import HFCs for use in the six applications listed in the AIM Act. Application-specific allowances may be conferred as needed to effectuate the production or import of the HFC. See the fact sheet Overview of Application-Specific Allowances under the AIM Act (pdf) for more information on application-specific allowances.

Purchasing or otherwise receiving bulk HFCs from a domestic chemical producer or an importer does not require an allowance.

What is the Methodology for Issuing 2022 General Pool Production and Consumption Allowances?

EPA describes the approach for allocating general pool allowances in Section VII of the final rule published October 5, 2021 (see the Federal Register Notice). The regulation also includes regulatory text at 40 CFR 84.9 and 84.11 describing the framework for issuing allowances. The methodology EPA employed for allowances issued on October 1, 2021, includes the following steps.

Step 1: EPA retrieved data reported to EPA’s Greenhouse Gas Reporting Program (GHGRP). Under Subpart OO of the GHGRP, facilities2 that import, export, or destroy more than 25,000 metric tons of carbon dioxide equivalent annually in fluorinated greenhouse gases, and all those that produce or transform fluorinated greenhouse gases, are required to submit annual reports to EPA detailing this activity. Facilities upload these annual reports using EPA’s “electronic Greenhouse Gas Reporting Tool,” or e-GGRT and certify the accuracy of the submissions.

Data that are submitted under Subpart OO in e-GGRT undergo a variety of verification checks during and after report submission. Facilities are sent messages about potential errors in their report; they can either reply, explaining the unusual values, or they can resubmit their report to correct any errors and certify the accuracy of the submission.

Step 2: EPA compared import data submitted to GHGRP to import data from U.S. Customs and Border Protection (Customs). Import data for all facilities that reported in 2020 and had not previously reported to e-GGRT were compared to Customs records. For any facility that reported data to e-GGRT between 2011 and 2019, import data were compared to Customs records. If the sum of metric tons of HFCs reported to e-GGRT diverged significantly from the sum of metric tons of imports under HFC-related HTS codes in Customs records, these submissions were flagged for possible issues.

Step 3: EPA reached out to facilities flagged as having potential issues after comparing GHGRP and Customs data. EPA contacted each facility that was flagged requesting that they either:

- Provide documentation (bills of lading, invoices, and/or U.S. Customs Entry Forms) substantiating their imports if the company stated data available in GHGRP was correct, or

- Resubmit their report to GHGRP to correct potential errors that would account for why the reported GHGRP data did not more closely align with data reported to Customs.

EPA staff reviewed resubmitted reports and supporting documentation. Any issues found in the documentation review resulted in additional messages sent to the facility.

EPA staff also searched the Chemical Data Reporting system (CDR) for entities that reported HFC import or production that did not appear in the GHGRP data and in limited instances compared reported data in CDR to data provided to EPA.

Step 4: EPA updated a master sheet to reflect the new data and corrected data submitted to GHGRP in steps 1 through 3 above.

Step 5: EPA assured the quality of the AIM-related data in EPA’s master sheet. Every AIM-related data element in the master sheet relevant to allocation decisions was manually checked by EPA to ensure that the chemical-specific quantities in the master spreadsheet reflected the Subpart OO report most recently submitted to e-GGRT. Each entry was manually verified at least once, with a selection of these entries verified multiple times.

Step 6: EPA grouped related e-GGRT facilities into single entities where appropriate consistent with EPA’s final regulations.3 Some entities have ownership over multiple production, transformation or destruction facilities that are required to report to e-GGRT individually. These facilities were grouped together with the controlling entity. Although imports and exports are required to be reported at the corporate level, several companies had acquired, spun-off or merged with other entities over time, leaving records from multiple facilities applying to just one potential allowance holder.

In e-GGRT, each facility has a reported “parent company” and a reported “owner.” Those data fields were EPA’s starting place in determining facility ownership. Where EPA determined there were potential issues surrounding the reported ownership of one or multiple e-GGRT facilities, facility owners were contacted to verify ownership. EPA also referred to comments submitted by stakeholders, web research, and the Dun & Bradstreet’s Hoovers corporate database. Where EPA had sufficient evidence that facilities were under “shared corporate or common ownership or control,” the data for the relevant facilities were grouped together into one entity.

Step 7: EPA reviewed requests for “special consideration” for entities that did not import in 2020, but wanted to receive allowances based on historic activity. If an entity did not import in 2020, general pool allowances were generally not allocated based on historic activity. However, entities were able to request special consideration if they notified EPA during the comment period on the rule, and EPA reviewed all such requests. EPA reviewed these entities’ historical HFC imports in e-GGRT and held meetings with the relevant stakeholders. If EPA could determine that the entity was still active in the market, EPA allocated allowances.

Step 8: EPA determined which entities were eligible for allowances based on the conditions established in the Final Rule. Entities that produced and imported and entities that imported more (in EVe terms) than they exported, transformed, and/or destroyed were eligible for production and/or consumption allowances. Entities that did not have 2020 imports or production, and did not receive “special consideration,” did not receive general pool allowances. Entities that did not have imports or production in 2011-2019, or had production and imports that were less than the amount exported, transformed, and/or destroyed, did not receive general pool allowances. In other words, companies who had negative calculated levels of production or consumption in all years were not issued allowances.

Step 9: EPA calculated annual production for entities potentially receiving allowances. For each entity potentially receiving allowances, EPA summed exchange value equivalent amounts from the AIM HFCs master sheet for production minus destruction minus production for transformation for each year between 2011 and 2019.

Step 10: EPA calculated annual consumption for entities potentially receiving allowances. For each entity potentially receiving allowances, EPA summed exchange value equivalent amounts from the AIM HFCs master sheet for production minus destruction minus transformation plus imports minus exports for each year between 2011 and 2019. For entities potentially receiving allowances that were associated with multiple facilities, yearly facility HFC activity was summed to get a year-by-year total of HFC production and consumption in metric tons of exchange value equivalent (MTEVe) at the level of the entity.

Step 11: EPA determined average high three-year levels for each entity potentially receiving allowances. EPA identified the three years with the highest production or consumption levels across 2011 through 2019 for each entity potentially receiving allowances—these years did not need to be consecutive. The highest years of production were identified separately from highest years of consumption (i.e., the three years need not match). The highest three years of production and consumption between 2011 and 2019 for every entity potentially receiving allowances were averaged to get a single pair of MTEVe values, one value for production and one for consumption, where relevant. If an entity only had one or two years of positive HFC production or consumption, EPA took that one year or the average of those two years, respectively, rather than treating the missing year(s) of data as zero in the average calculation.

Step 12: EPA determined allocations for each entity. All entity production averages were added together for an industry-wide production total of 357,838,394 MTEVe. The same was done for consumption averages to determine a consumption total of 383,412,342 MTEVe. Each entity’s production and consumption average was divided by these industry-wide totals, respectively, to determine a relative percentage of production and consumption allowances. This percentage was then multiplied by the amount of production or consumption allowances available in 2020, less the set-aside and application-specific allowance amounts, to get entity-specific production and consumption allocations in MTEVe. Allocations were rounded to the one-tenth of a MTEVe after all calculations were completed.

The entity level allowance calculations were performed separately by three different EPA employees, one using the R statistical programming language and two using Excel formulas. The results of all three analyses were compared to ensure consistency. Additional spot checks were conducted to ensure the accuracy of the data.

What is the Methodology for Issuing 2022 Application-specific Allowances?

EPA describes the approach for allocating application-specific allowances in Section VII of the final rule published October 5, 2021 (see the Federal Register Notice, particular Section VII.C). The regulation also includes regulatory text at 40 CFR 84.13 describing the process and criteria for issuing allowances. The methodology EPA employed for allowances issued on October 1, 2021, includes the following steps.

Step 1: In order to calculate application-specific allowance quantities for each entity, EPA looked to verified data. Specifically, EPA considered data verified based on submitted consumption data, invoices, shipping documentation, purchase orders, purchase receipts, goods receipts, sales data, or units/quantities received from manufacturers or suppliers multiplied by the amount of HFCs in each unit of that product (e.g., the number of MDIs acquired in a given year multiplied by the average quantity and type of HFC in each unit).

Step 2: EPA converted the HFCs in kg to exchange value-weighted quantities and calculated sums of annual verified quantities for each entity and across applications.

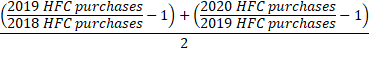

Step 3: EPA calculated application-wide average annual growth rates (AAGRs) based on verified data in 2018 through 2020. In order to do this, first EPA removed chemical-specific HFC data from application-wide totals for entities where supporting documentation for their data was not provided or was incomplete (e.g., an entity was only able to provide some of its invoices in a given year). Inclusion of data that was incomplete would skew the average annual growth rates by creating the appearance of an artificially low number in one year—resulting in a higher growth rate than was actually realized. If EPA confirmed that an entity purchased zero HFCs, the zero value was kept in the application-wide totals.

EPA then summed all exchange value-weighted HFC quantities by application for each year. In order to calculate an application-wide AAGR, EPA used the following formula:

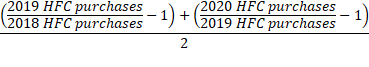

Step 4: EPA used the following formula to calculate entity-specific average annual growth rates for each entity with verified data for 2018, 2019, and 2020:

For entities that failed to provide supporting documentation to allow EPA to verify data for all three years, whether fully or partially, based on comparisons to the information they submitted in their questionnaire or from correspondence, EPA applied the application’s AAGR between 2018-2020 to the 2020 purchase value.

For entities that were missing data or provided incomplete data in any year, EPA applied the application’s AAGR between 2018-2020 to the 2020 verified value. If EPA verified that a company had zero HFCs in any year for all HFCs, the Agency was unable to calculate an entity-specific growth rate for them using the above formula (i.e., a growth rate cannot be calculated when there is a zero in the denominator).

Step 5: To determine an individual entity’s allocation, EPA generally multiplied the entity’s 2020 data by the higher of the entity’s average annual growth rate or the application’s average annual growth rate, after squaring that growth rate to account for two years of growth (between 2020 and 2022).

If a company was only able to provide data for 2020, EPA multiplied their 2020 HFC purchases by the square of the application AAGR.

If the average annual growth rate was negative for an entity and for the application, EPA allocated allowances equal to the highest quantity of HFCs reported over the three years between 2018-2020. EPA applied the same approach to a company that did not provide supporting documentation for HFC purchases for 2020 or 2018, but provided an explanation that they continue to use HFCs and purchase HFCs irregularly (e.g., every other year).

Step 6: As described in the final rule, EPA also considered individual unique circumstances that may merit an increased allocation beyond historical growth rates if sufficiently documented. In this allocation, EPA considered the following circumstances as meriting additional allowances:

- Demonstrated increases in manufacturing projected for the next calendar year; or

- The acquisition of another domestic manufacturer or its manufacturing facility or facilities.

Some entities requested allowances additional to their historic growth rate because of new manufacturing plants or expanded manufacturing lines scheduled to come online within the next calendar year. In such situations, EPA requested projections of quantities of additional HFCs needed by month and estimated start dates. EPA required that entities provide sufficient documentation to show this increased manufacturing capacity, and accepted documentation such as news articles and building permits.

Similarly, some entities requested additional allowances for new products that they expect to produce in 2022 beyond what would be calculated from historic growth rates.

For entities that made an allowance level request based on acquiring another entity, EPA accepted supporting documentation such as an SEC 8-K filing and confirmed with the acquired entity that all of its manufacturing facilities had been acquired. EPA relied on data from the acquired entity to determine allowances that were allocated to the current owner.

Step 7: For final allowance calculations, EPA did the following:

- For entities requesting additional allowances due to the construction of a new facility or manufacturing capacity, EPA calculated an allocation based on average growth rate, as outlined in Steps 2, 3, and 4, and added additional allowances to account for new construction if verified.

- For entities requesting additional allowances for new products that they expect to produce in 2022, EPA added to quantities calculated in steps 2, 3, and 4 based on their requests in the same manner as reviewing data on new manufacturing capacity.

- For entities requesting additional allowances due to the acquisition of another entity that also submitted data, EPA combined their values from Step 2 before calculating their AAGRs.

- For all other entities, except the Department of Defense (DOD), EPA calculated final quantities as outlined in Step 5.

- EPA did not include entities that do not use HFCs in one of the applications included in subsection (e)(4)(B)(iv).

1 Consumption is the amount of HFCs newly added to the U.S. market through production and import, minus exports and destruction.

2 EPA uses the term “facility” throughout this page to refer to the business unit reporting to GHGRP.

3 EPA is using “entity” in this web page to refer to facilities or associated collections of facilities that were considered for allowances. As explained in the final rule, EPA is treating all companies majority owned and/or controlled by the same individual(s) as a single entity.