Federal Programs

Federal programs can help communities advance brownfield site cleanup and redevelopment activities. The Brownfields Federal Programs Guide has more information on tax incentives and credits. Also check for similar programs offered by your state

Under the 2021 Bipartisan Infrastructure Law and the 2022 Inflation Reduction Act, Congress provided major funding outside the regular appropriations process to federal programs in support of planning, construction and operation of various public infrastructure improvements. These laws include new and existing federal programs that could be relevant and valuable for brownfield and community revitalization projects.

Energy Community Tax Credit Bonus

- As defined in the 2022 Inflation Reduction Act, this credit applies a bonus of up to 10% (for production tax credits) or 10 percentage points (for investment tax credits) for projects, facilities and technologies located in energy communities.

- The IRA defines “energy communities” and the types of brownfield sites that are eligible for the tax credit.

- The “energy communities” brownfield definition relevant to the tax credit and the brownfield definition used to determine eligibility for federal brownfields funding are different. Review eligibility with the proposed IRS regulations because the energy communities' brownfields definition is more limited.

- EPA cannot make brownfield designations for tax credit purposes. The IRS—not EPA—has authority to administer this tax credit, including determining what documentation will be required to take advantage of the energy communities tax credit.

Energy Efficiency and Renewable Energy Incentives

Investors and communities can use these incentives to create energy redevelopment projects on brownfields.

- Tax Deductions for Energy-Efficient Commercial Buildings – Available to owners of new or existing buildings who install lighting, heating, cooling, ventilation or other systems that reduce the building’s total energy and power costs.

- Business Energy Investment Tax Credit – Available to businesses to offset capital expenditures for solar, geothermal, fuel cells, microturbines and hybrid solar lighting systems.

- Renewable Electricity Production Tax Credit – Available for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year.

- Renewable Energy Bonus Depreciation Deduction – Available for recovering the cost of business- or income-producing, renewable-energy properties through deductions for depreciation.

Historic Rehabilitation Tax Credits

These credits discourage demolition of sound older buildings, slow the loss of businesses from older urban areas and encourage private investment in the cleanup and rehabilitation of historical properties. Read more about historic rehabilitation tax credits.

Credits in Action

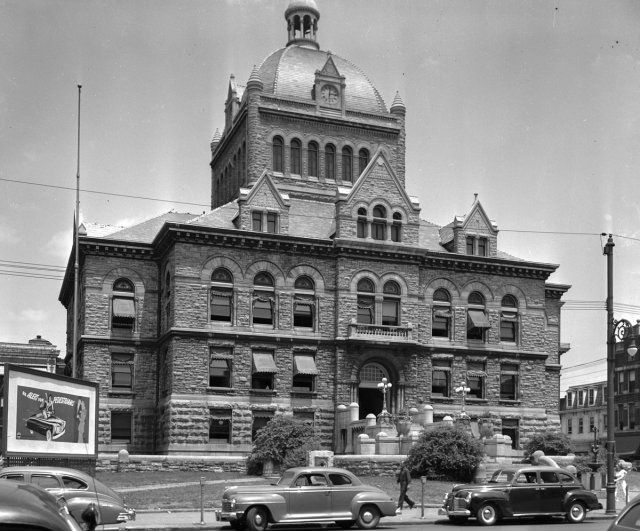

Built in 1898, the historic Fayette County Courthouse was redeveloped using state and federal historic tax credits. Built in 1898, the historic Fayette County Courthouse in Lexington, Kentucky, was in service by the courts for more than 100 years before operations moved to a larger building. City officials restored the building for several uses, including a restaurant and bar, office space, visitor’s center and event hall.

The project was eligible for more than $11 million in state and federal historic tax credits, but it had to meet strict requirements to qualify. For example, the building had to house both for-profit and nonprofit entities and developers had to document the building’s existing condition and submit the renovation plans for approval to the National Park Service and the Kentucky Heritage Council/State Historic Preservation Office before any work could begin. Once approved, developers had to confirm they had performed each step of the plan exactly as intended over the course of the project.

Low-Income Housing Tax Credits

These tax credits encourage the use of private equity to develop affordable housing for low-income residents. State housing agencies allocate the credits to help ensure an attractive minimum rate of return on investments in low-income housing.

Brownfield developers may use Low-Income Housing Tax Credits as part of a financing package if the project includes affordable rental housing. Read more about the low-income housing tax credits.

New Markets Tax Credits

This program stimulates the economies of distressed urban and rural communities and creates jobs in low-income communities by expanding the availability of credit, investment capital and financial services.

Each year, the U.S. Department of the Treasury allocates tax credits through its Community Development Financial Institutions Fund and distributes them to qualified Community Development Entities (CDEs). These entities include organizations such as banks, community development corporations, community development financial institutions, small business development corporations and others.

Brownfield developers can approach CDEs to help fund their projects or, under certain circumstances, apply for CDE certification themselves. Read more about new markets tax credits.

Credits in Action

Built on a Duluth industrial pier previously used as a cement facility, the Pier B Resort was developed using federal New Markets Tax Credits. Located on Lake Superior and the St. Louis River Estuary, Duluth has a rich waterfront history. It was the fifth-largest seaport in the United States by the 1890s, but after many decades of operation, industrial use of the city’s waterfront began to decline in the 1960s.

Through public and private partnerships, including support from federal New Markets Tax Credits, city planners were able to obtain enough support to help make redevelopment possible.

Opportunity Zones Incentive

This program promotes investment in the development of real estate and businesses in Qualified Opportunity Zones. These zones are census tracts of low-income and distressed communities designated by state governors and certified by the U.S. Department of the Treasury. Taxpayers who invest in Qualified Opportunity Zone property through a Qualified Opportunity Fund can temporarily defer taxes on the amount of eligible gains they invest.