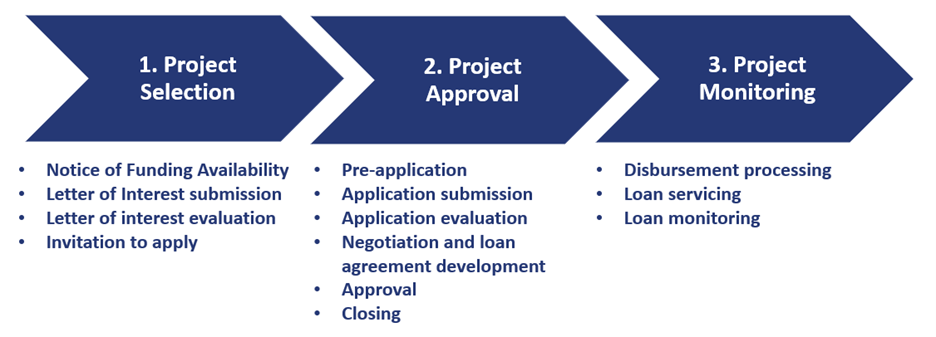

WIFIA Loan Process

The WIFIA Loan Process has three main phases – project selection, project approval, and project monitoring – with several steps within each phase. More detailed information about the WIFIA loan process can be found in the WIFIA Program Handbook.

Phase 1: Project Selection

Each year, the WIFIA program receives an appropriation that replenishes the amount of funding that can be made available to prospective borrowers. With that appropriation, EPA also announces priorities that help the WIFIA program support the Agency’s mission and strategic goals. EPA announces this funding in a Notice of Funding Availability published in the Federal Register. In the Letter of Interest (LOI), prospective borrowers provide information that EPA uses to determine the project’s eligibility, creditworthiness, engineering feasibility, and alignment with EPA’s policy priorities. Based on these reviews, EPA selects projects which it intends to fund and invites them to continue to the application process.

The LOI form and additional resources are available at WIFIA Application Materials.

Phase 2: Project Approval

Each invitee must submit an application for WIFIA credit assistance. Using this information, the WIFIA program conducts a detailed evaluation of the project. EPA proposes terms and conditions for the project and negotiates with the applicant until they develop a mutually agreeable term sheet and loan agreement. Prior to closing, the WIFIA program must receive approval from the EPA Administrator or his designee and the Office of Management and Budget (OMB). At closing, EPA and the applicant execute the term sheet, which obligates the WIFIA funds, and the loan agreement, which is the binding legal document that allows the borrower to receive WIFIA funds.

The application and additional resources are available at WIFIA Application Materials.

Phase 3: Project Monitoring

Following loan closing, borrowers must meet several requirements to receive funding and remain in compliance with the loan agreement. There are three main categories of project monitoring activities: disbursements, loan servicing, and loan monitoring. The executed loan agreement will identify specific requirements pertaining to each credit instrument.